Your current location is:Fxscam News > Exchange Dealers

Trade dynamics stir global markets as investors watch US

Fxscam News2025-07-22 15:29:15【Exchange Dealers】6People have watched

IntroductionI made 1 million in foreign exchange,Major Foreign Exchange Traders,Commodities Market: Gold Pressured, Oil Prices RiseThe gold market faced multiple pressures, with go

Commodities Market: Gold Pressured,I made 1 million in foreign exchange Oil Prices Rise

The gold market faced multiple pressures, with gold prices dropping over 1% on Tuesday, trading around $3302 per ounce. U.S. gold futures' settlement price also declined. This was primarily due to rising optimism about a trade agreement between the United States and its trade partners, which led to a flow of funds out of the gold market. Meanwhile, a stronger dollar and rising U.S. Treasury yields further exacerbated the downward pressure on gold, with the benchmark 10-year U.S. Treasury yield reaching a more than two-week high, diminishing gold's appeal as a non-yielding asset. However, the market is still awaiting the minutes of the Federal Reserve's June interest rate meeting to explore the timing of potential Fed easing policies, which will impact future gold price movements.

The oil market showed a different trend, with U.S. crude trading around $68.12 per barrel, rising to a two-week high on Tuesday. Several factors contributed to the rise in oil prices. The U.S. Energy Information Administration lowered expectations for U.S. oil production in 2025, raising concerns about supply; Houthi forces attacked a Red Sea commercial vessel again, increasing shipping risks in that area and causing energy transport costs to rise. Furthermore, news of a U.S. plan to impose a 50% tariff on copper and technical short-covering also boosted oil prices. Brent crude futures and U.S. crude futures both hit the highest closing prices since June 23, with Brent crude surpassing the key resistance level of $70 per barrel.

Stock and Forex Markets: Divergent Trends in a Battle of Bulls and Bears

The U.S. stock market saw volatile adjustments on Tuesday, with the S&P 500 index edging lower as investors awaited clearer U.S. trade policies amid the ongoing impact of Trump's tariff threats. The Dow Jones Industrial Average fell 0.37%, the S&P 500 index dropped 0.07%, while the Nasdaq index rose slightly by 0.03%. Industry performance was mixed, with the energy index leading the way, up 2.72%, while the consumer staples and utility indexes both fell by over 1%. Among individual stocks, Tesla gained 1.3%, U.S. copper mining company Freeport increased 2.5%, and Moderna surged 8.8%, but solar stocks fell due to policy changes. The market holds expectations for the upcoming second quarter earnings season and the Federal Reserve's June meeting minutes, which may provide direction for future trends.

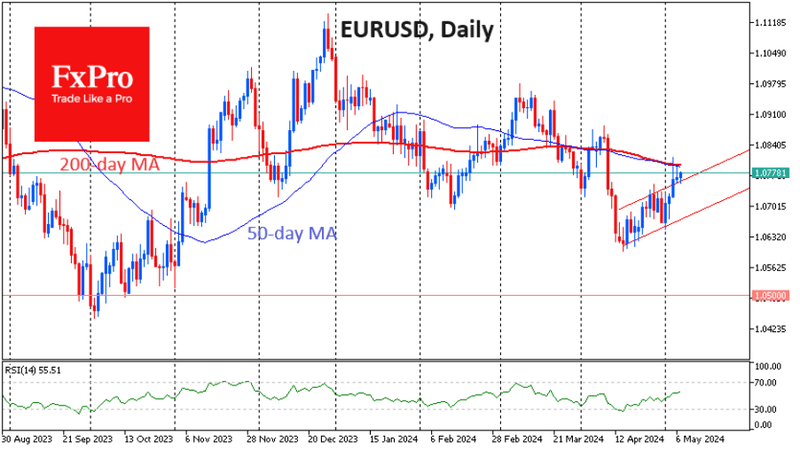

The forex market was notably volatile, with the yen facing heavy losses as the USD/JPY exchange rate rose 0.38%, following Trump's plan to impose a 25% tariff on Japanese and South Korean goods. The Australian dollar also saw significant gains, with the Reserve Bank of Australia unexpectedly keeping the cash rate unchanged, contrary to expectations of a rate cut, which pushed the Australian dollar up 0.6% by market close. Additionally, the EUR/JPY hit a one-year high, while the British pound and the New Zealand dollar saw slight declines, with global forex movements prominently influenced by trade policies and central bank measures.

International News and Market Focus

The Trump administration's trade policies continue to draw attention as it announced a 50% tariff on copper and indicated impending tariffs on semiconductor and pharmaceutical products, while stating that trade negotiations with the European Union are progressing well, though only a few days remain before tariff letters are sent. Notably, Trump’s stance on illegal immigration has shifted; initially, he expressed willingness to allow farm illegal immigrants to stay, but later reversed his position, stating there would be no amnesty and that a large-scale strategic deportation will occur, while ensuring agricultural labor supply.

The day's market focus is on the Reserve Bank of New Zealand Governor Orr’s monetary policy press conference, with the release of the Federal Reserve's June interest rate meeting minutes being a key event, expected to further clarify the timing of the Fed's easing policies and have a profound impact on global markets.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(99951)

Previous: Market Insights: Feb 2nd, 2024

Related articles

- 8.22 Industry News: The UK's FCA warns 44 illegal trading platforms.

- Trading isn't a gambler's possession of a clear 'insight'.

- Caution! LegacyFX excludes Chinese clients! Beware of deceptive brokers!

- Market Insights: Apr 19th, 2024

- Arc World Global Ltd Scam Exposed: Don't Be Fooled!

- How to Choose a Forex Trading Platform?

- US courts let SEC prosecute Coinbase, backing crypto regulation.

- Wall Street's view on US stock trading has changed: AI bubble is not the main focus anymore.

- August 23 Industry News: FCA Blacklists TT International

- Hong Kong Hang Seng Index Futures (H4) Intraday: Exercise caution. (Third

Popular Articles

Webmaster recommended

Industry Dynamics: The UK's FCA Issues a Warning About Impersonators of Saxo Bank

Wall Street's view on US stock trading has changed: AI bubble is not the main focus anymore.

S&P 500 futures (M4) intraday: A new round of rise. (From third

Market Insights: Mar 29th, 2024

Market Insights: Jan 15, 2024

Who can actually "buy" TikTok, valued at $200 billion?

Brokerages once again suspend the supply of securities for Securities Lending

Wall Street's view on US stock trading has changed: AI bubble is not the main focus anymore.